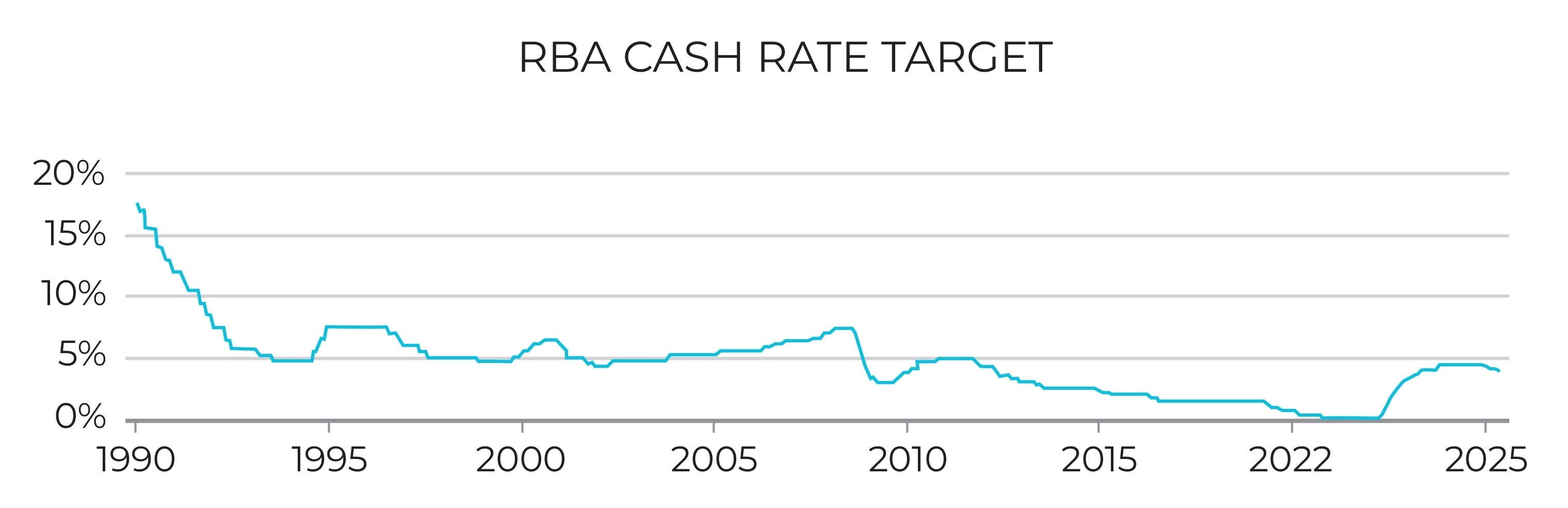

More than 65 lenders, including the big four banks, have cut their interest rates following the Reserve Bank of Australia’s decision to reduce the cash rate from 4.10% to 3.85%.

This will mean lower repayments for the typical variable-rate borrower – although the size of the rate cuts, and the dates at which they’re taking effect, is varying from lender to lender.

Here are three tips to bear in mind in this downward interest rate environment:

- Think about refinancing. If your lender is not making the right competitive moves with your interest rate, I can compare the market for you and search for better options.

- Review your new borrowing power. Lower interest rates can increase how much you can borrow, which may open up new opportunities to upsize, renovate or invest. Just be careful not to overextend yourself.

- Use your savings wisely. Consider what you do with the money you save with a lower rate. Splurging on treats may be satisfying, but investing the money, making extra repayments on your loan or building the balance in your offset account may be a smarter long-term option.

Editor's Pick

Australia's median property price has now increased for seven consecutive months, after rising another 0.7% in August, according to Cotality. Three main factors have been driving this [...]

Property investor activity is close to eight-year highs, the latest data from the Australian Bureau of Statistics has confirmed. Investors took out 37.7% of all new home [...]

“This February’s rate cut was a clear turning point for housing value trends,” said Cotality research director Tim Lawless – and the numbers back him up. National [...]

Related Posts

Australia's median property price has now increased for seven consecutive months, after rising another 0.7% in August, according to Cotality. Three main factors have been driving this [...]

Property investor activity is close to eight-year highs, the latest data from the Australian Bureau of Statistics has confirmed. Investors took out 37.7% of all new home [...]

“This February’s rate cut was a clear turning point for housing value trends,” said Cotality research director Tim Lawless – and the numbers back him up. National [...]