|

“This February’s rate cut was a clear turning point for housing value trends,” said Cotality research director Tim Lawless – and the numbers back him up.

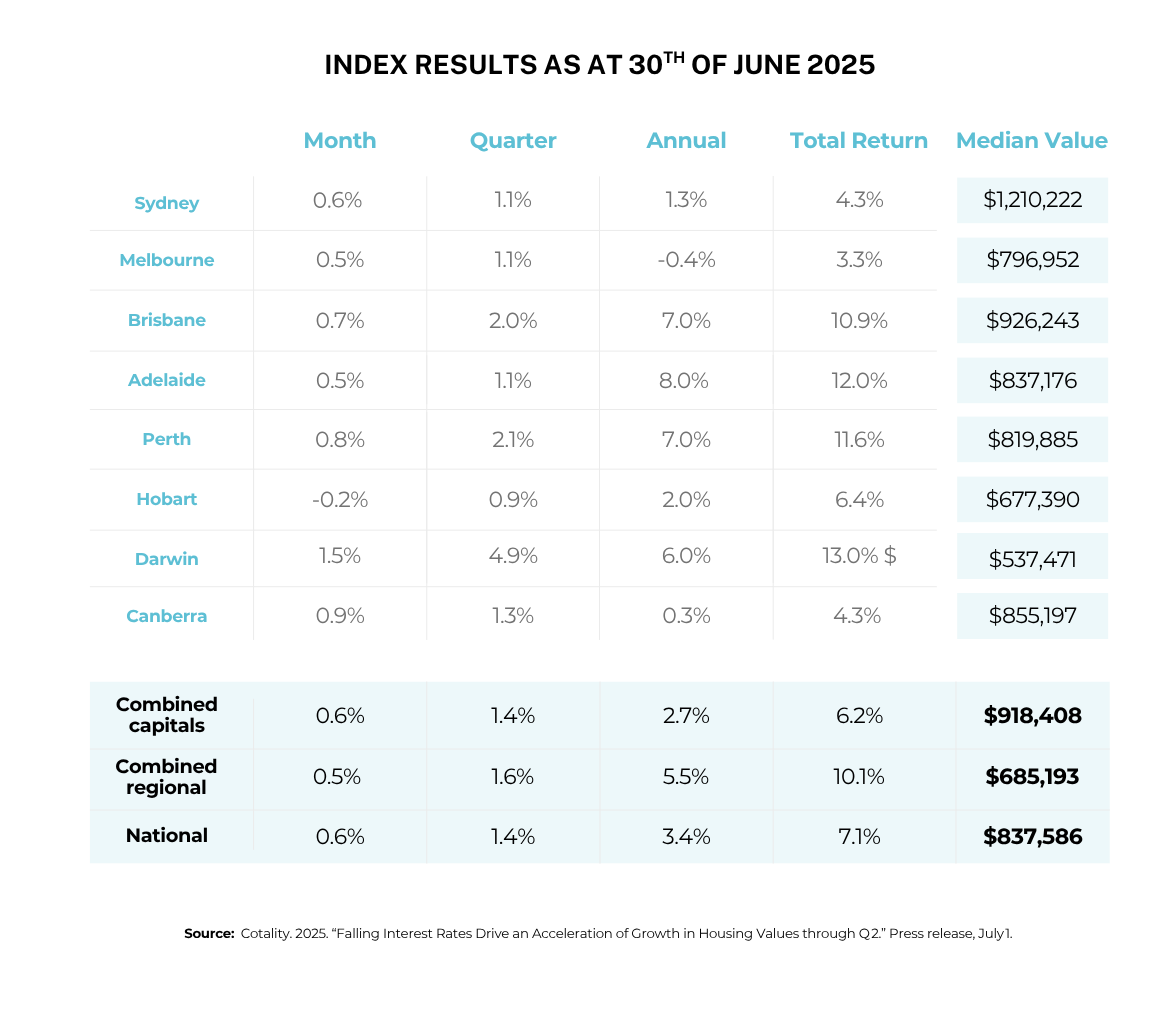

National property prices rose 0.6% in June, marking the fifth consecutive month of growth. Over the past five years, the national median has increased by 44.3%, despite several dips along the way.

Mr Lawless said the latest growth cycle is being fuelled by falling interest rates. “An additional cut in May, and growing certainty of more cuts later in the year have further fuelled positive housing sentiment, pushing values higher.”

|

|

In a market where interest rates are coming down and prices are creeping up again, here are three things to keep in mind:

- Buyers are getting off the fence. Lower rates are bringing more competition back to the market. Be ready to move quickly.

- Your borrowing power may increase. As rates fall, you might qualify for a larger loan but property prices are rising too.

- Timing your move matters. With prices rising, waiting could mean paying more later.

Want to get ahead of the next rate cut? Let’s chat about your plans.

Editor's Pick

Australia's median property price has now increased for seven consecutive months, after rising another 0.7% in August, according to Cotality. Three main factors have been driving this [...]

Property investor activity is close to eight-year highs, the latest data from the Australian Bureau of Statistics has confirmed. Investors took out 37.7% of all new home [...]

“This February’s rate cut was a clear turning point for housing value trends,” said Cotality research director Tim Lawless – and the numbers back him up. National [...]

Related Posts

Australia's median property price has now increased for seven consecutive months, after rising another 0.7% in August, according to Cotality. Three main factors have been driving this [...]

Property investor activity is close to eight-year highs, the latest data from the Australian Bureau of Statistics has confirmed. Investors took out 37.7% of all new home [...]

“This February’s rate cut was a clear turning point for housing value trends,” said Cotality research director Tim Lawless – and the numbers back him up. National [...]